Investing in real estate can be a lucrative venture, but it is essential to evaluate the return on investment (ROI) of potential properties before making a purchase. Understanding how to assess the ROI of investment properties is crucial for making informed decisions and maximizing profits in the long run. By taking into account various factors such as rental income, expenses, and market trends, investors can determine the potential profitability of a property. In this article, we will explore the key considerations and methods for evaluating the ROI of investment properties.

Understanding Rental Income Potential

One of the primary factors to consider when evaluating the ROI of an investment property is the potential rental income it can generate. The rental income is the revenue you can expect to receive from tenants occupying the property. It is essential to research the rental market in the area to determine the average rental rates for similar properties. By analyzing rental listings and speaking with local property managers, investors can gain insight into the potential rental income of a property.

Additionally, investors should consider factors such as vacancy rates, demand for rental properties, and the property’s location when evaluating its rental income potential. Properties located in high-demand areas with low vacancy rates are more likely to generate consistent rental income and provide a higher ROI in the long term.

Calculating Expenses and Cash Flow

In addition to rental income, investors must also consider the expenses associated with owning and operating an investment property. Common expenses include property taxes, insurance, maintenance and repairs, property management fees, and mortgage payments. By accurately estimating these expenses, investors can calculate the property’s cash flow, which is the net income generated from rental income after deducting expenses.

To determine the property’s cash flow, investors can use the formula: Rental Income – Operating Expenses = Cash Flow. A positive cash flow indicates that the property is generating more income than expenses, while a negative cash flow means that the property is not generating enough income to cover expenses. Investors should aim for a positive cash flow to ensure the property is profitable and provides a good ROI.

Analyzing Market Trends and Appreciation Potential

Another important factor to consider when evaluating the ROI of an investment property is its potential for appreciation. Property appreciation refers to the increase in the property’s value over time, which can result from factors such as market demand, location, and improvements made to the property. By analyzing market trends and historical data, investors can determine the property’s potential for appreciation and long-term growth.

Properties located in areas experiencing strong economic growth, population growth, and infrastructure development are more likely to appreciate in value over time. Investors should also consider the property’s condition, age, and potential for renovations or improvements that can increase its value. By assessing the property’s appreciation potential, investors can make informed decisions about its long-term profitability and ROI.

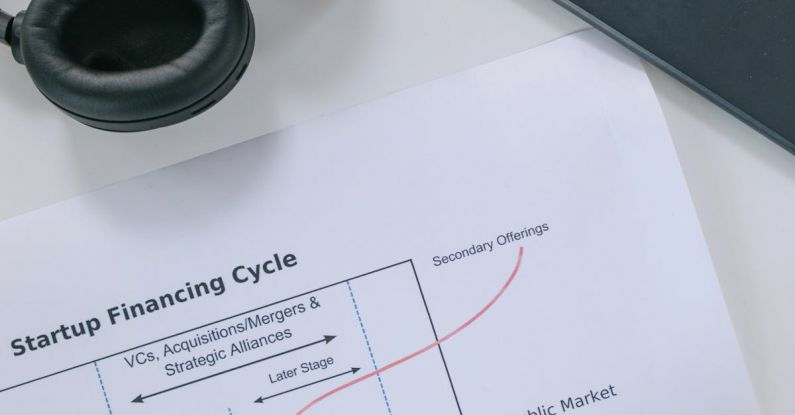

Evaluating Return on Investment (ROI)

Once investors have considered rental income, expenses, market trends, and appreciation potential, they can calculate the property’s ROI to determine its profitability. ROI is a key metric used to assess the return on an investment relative to the initial cost. The formula for calculating ROI is: (Net Profit / Cost of Investment) x 100 = ROI. Net profit is calculated by subtracting the total expenses from the total income generated by the property.

By calculating the ROI of an investment property, investors can determine whether the property is a sound investment that aligns with their financial goals and expectations. A higher ROI indicates a more profitable investment, while a lower ROI may signal potential risks or challenges that could impact the property’s profitability in the long term.

In conclusion,

Evaluating the ROI of investment properties is a critical step in the real estate investment process. By carefully analyzing rental income, expenses, market trends, and appreciation potential, investors can make informed decisions and maximize profits. Understanding how to assess the ROI of investment properties can help investors identify profitable opportunities, mitigate risks, and achieve their financial goals in the competitive real estate market. By following these key considerations and methods, investors can make sound investment decisions that lead to long-term success and financial prosperity.