When it comes to investing, real estate stands out as a popular choice for many individuals seeking to build wealth. However, navigating the real estate market can be complex and challenging, especially for newcomers. To succeed in real estate investment, it is crucial to have a solid strategy in place. In this article, we will explore some of the best strategies for real estate investment that can help you make informed decisions and maximize your returns.

Diversify Your Portfolio

One of the key strategies for successful real estate investment is diversification. By spreading your investments across different properties or types of real estate, you can reduce risk and increase your chances of generating consistent returns. Diversification can help protect your portfolio from fluctuations in the market and unexpected events that may impact a single property or sector.

Research and Due Diligence

Before making any investment decision, it is essential to conduct thorough research and due diligence. This includes analyzing market trends, property values, rental rates, and potential risks. By taking the time to educate yourself about the real estate market and the specific properties you are interested in, you can make more informed decisions and minimize the likelihood of costly mistakes.

Location, Location, Location

The old adage “location, location, location” holds true in real estate investment. The location of a property can significantly impact its value, rental potential, and overall return on investment. When selecting properties to invest in, consider factors such as proximity to amenities, schools, public transportation, and job centers. A property in a desirable location is more likely to attract tenants and appreciate in value over time.

Long-Term Investment Horizon

Real estate is a long-term investment that requires patience and a strategic approach. Instead of focusing on short-term gains, consider the long-term potential of a property and its ability to generate consistent cash flow and appreciation over time. By adopting a long-term investment horizon, you can weather market fluctuations and benefit from the compounding effect of real estate appreciation.

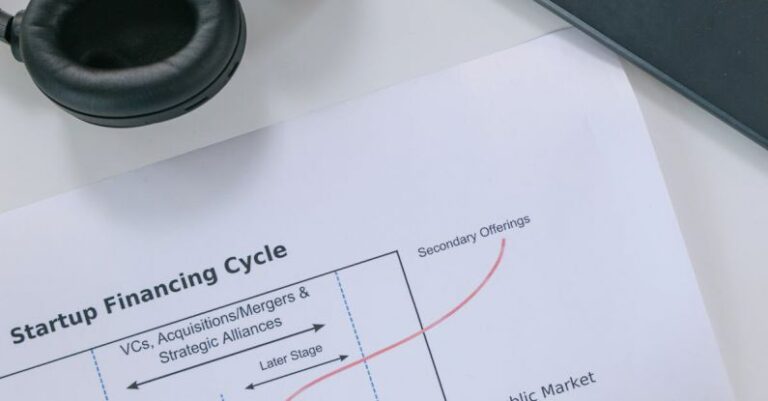

Leverage Financing Options

Financing plays a crucial role in real estate investment, especially for those looking to acquire properties with limited capital. Leveraging financing options such as mortgages, loans, or partnerships can help you maximize your purchasing power and expand your real estate portfolio. However, it is essential to carefully evaluate the terms and risks associated with each financing option to ensure it aligns with your investment goals.

Property Management

Effective property management is essential for maximizing the returns on your real estate investments. Whether you choose to manage your properties yourself or hire a professional property management company, it is crucial to maintain the property, address tenant issues promptly, and ensure that rental income is collected consistently. Good property management can help you attract and retain quality tenants, minimize vacancies, and protect the value of your investment.

Monitor Market Trends

The real estate market is dynamic and influenced by a variety of factors, including economic conditions, interest rates, and demographic trends. To stay ahead of the curve, it is essential to monitor market trends and adjust your investment strategy accordingly. Stay informed about local market conditions, emerging trends, and regulatory changes that may impact the real estate market. By staying proactive and adaptable, you can position yourself for success in the ever-evolving real estate landscape.

In conclusion, real estate investment can be a lucrative and rewarding endeavor for those who approach it with a well-thought-out strategy. By diversifying your portfolio, conducting thorough research, focusing on location, adopting a long-term investment horizon, leveraging financing options, prioritizing effective property management, and monitoring market trends, you can increase your chances of success in the competitive world of real estate investment. Implementing these strategies can help you make informed decisions, mitigate risks, and achieve your financial goals through real estate investment.